Modernize and scale 100% of your business

Tailored solution to automate your unique billing, revenue and partner commission process

Management

Reduce Revenue Leakage

Revenue Leakage relates to preventable loss of revenue, which is earned but not collected. Manual processes, spreadsheet-driven billing calculations and disparate systems are common causes of lost revenue.

MGI Research estimates that in North America, revenue leakage averages between 3% and 7% of annual revenues. MGI Research estimates that for the planning period of 2020 to 2025 international revenue leakage will on average be at least 50% higher than domestic revenue leakage. MGI Research expects that between 2020 and 2025, organizations that modernize their global monetization systems and adapt best practices will see a 30-40% reduction in revenue leakage domestically and a 50 – 60% reduction in revenue leakage internationally.

“A leading technology company estimates a 0.5% blended total revenue lost through manual processes and errors equating to $8 M impact on their P&L per annum.” In some business units, this could be as high as 10%.

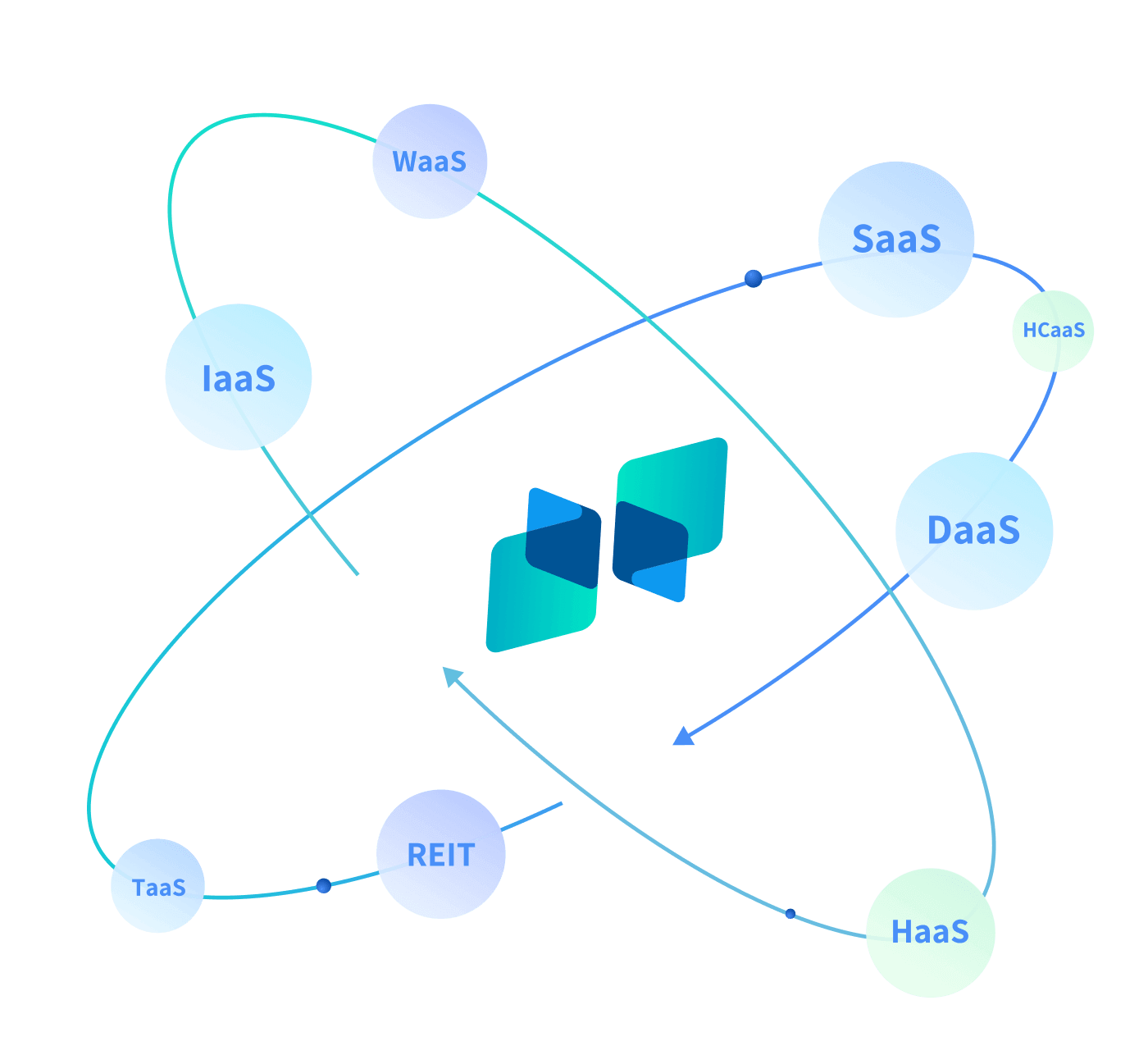

Accelerate Revenue

Enterprises across industries are moving from selling products to selling services, but historical systems are built to monetize products and not services. Modern companies need to be able to cater to historical models, current trends and future opportunities.

Additionally, the movement to service revenue models is revolutionizing peripheral industries (such as warehousing and logistics). WaaS and other evolutions are growing to satisfy the service economy. Complex billing needs are compounded as highly complex, high volume and integrated billing, sharing and reporting requirements result.

RecVue automates any revenue model.

Increase Working Capital

Days Unbilled Outstanding (DUO) is an important component of Days Sales Outstanding (DSO), together with Collections, and Cash Allocation. Without benchmarking each Business Unit in terms of time to bill, Companies are oblivious to the Cash and therefore Working Capital gains available through automating all business units, revenue streams or order types. Measuring Working Capital potential, and conversely – P&L impact of optimizing speed to bill provides organizations with a clear view as to annual potential which may be clouded by a blended view. The ability to automate the billing of Anything as a Service, alongside any legacy and future business models creates a standardized DUO across all billing types.

RecVue, the monetization cloud that works with your ERP

Digital Business Acceleration

Introduce innovative business models at scale.

Billing

Completeness

Ensure accurate and precise billing for faster cash flow.

Revenue Recognition Compliance

Revenue recognition accounting to meet ASC 606 and IFRS 15 guidance.

Simplify Revenue Share with Partners

Manage revenue share across channel partner networks.

“Leveraging Recvue’s technology platform will enable Hertz to continue our digital transformation journey and respond to evolving customer demand.”

David James,

VP Corporate and Financial Systems

“After evaluating RecVue, we realized that we had found a solution that aligned with the complexities of our business.”

Gregory Coan

CIO, Textainer

“RecVue was able to simply and efficiently address the challenges we were having with our complex subscription pricing and recurring billing rules. No other platform on the market has the flexibility and scalability to manage the growth in our recurring revenue business. It’s been a true partnership.”

William Vessels

Director of Business Process Management, Fiber at Crown Castle

“With the 5G revolution, we have a growing number of competitors. We needed a billing and revenue recognition solution that would support our business growth as we gain market share from existing competitors and fend off new entrants. RecVue was the perfect partner we needed on this journey.”

Joe Cummings

VP Information Technology, ExteNet

“RecVue is a best fit for complicated, multilayered billing scenarios”

The Forrester Wave™,

The Forrester Wave™ SaaS Billing Solutions, Q4 2019

“Future-focused companies are adopting agile monetization systems such as RecVue Agile Monetization Platform (RAMP360) suite to easily implement complex recurring business models, automate the order-to-cash process, and easily manage partner settlement to enable the goal of continuous accounting close.”

Mark Thomason,

Research Director for Digital Business Models and Monetization

Why Recvue

100% Automation of all complex billing, Revenue Share and Revenue Recognition Requirements – at scale.

- RecVue is unique in our ability to satisfy 100% of our customer’s complex billing requirements through a standard, configurable SaaS² solution with a unique service, expertise and architecture.

- Unlike Mass Market solutions, our platform can be tailored for an exact fit – to all complex use cases, at scale.

The RecVue monetization cloud, along with unique services and expertise can be configured to fit your legacy, current and future revenue models.

- Modern Cloud solution built to unify, rationalize and replace multiple legacy and custom built and home-grown solutions.

- Our Integration Platform, built on our own Data Mediation Layer supports seamless integrations regardless of system landscape. Integration capabilities have become essential in supporting continuous transformation initiatives designed to support a continuously evolving enterprise.

- Supports all business models: Anything as a Service (XaaS), legacy and future revenue streams. As companies evolve, business models tend to be additive as opposed to replacing, but so does the system integration Landscape

Asset Monetization As-A-Service

A single platform embedded with Asset Billing, Asset Payment, and Revenue

Learn More